Triangle patterns

Typical Triangle Consolidation pattern

Consolidation price zone

On the 5 min chart below we see the large triangle consolidation pattern, which got broken to the downside.

The market price of the EUR/USD moved down to the 61.80 % Fibonacci Extension and started a retracement back into the triangle consolidation price zone.

The Consolidation price zone of a recent consolidation pattern often acts as Resistance/ Support when market price retraces back into this price zone for the first time. So, the Euro retraced back up into the triangle consolidation price zone and market price rolled over to the downside most probably due to the recent consolidation chart pattern.

The Euro terminated its retracement and started its second leg down. The following typical three market swing consolidation pattern between 11 a.m. and 1 p.m. GMT took as usual more time then the prior impulsive leg and the consolidation pattern also consists of three market swings. The consolidation pattern terminated after the third market swing of the consolidation pattern and market price continued its move down to the major Support zone of the monthly Pivot and daily S2 Pivot, from where market price finally bounced back to the upside.

|

| 5 min Triangle Consolidation Chart Pattern |

Another Example of a Triangle Breakout

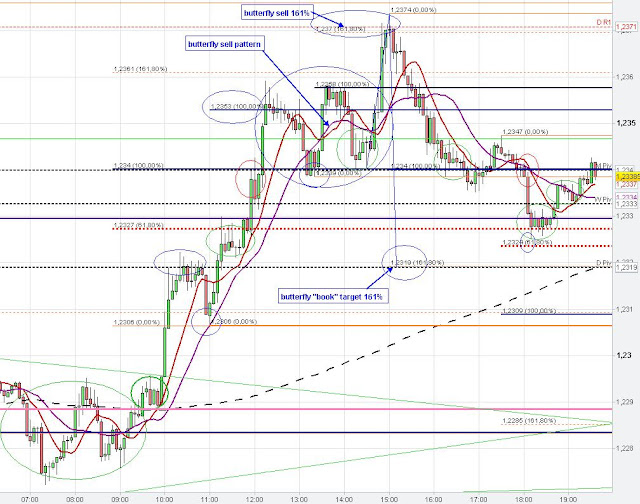

Butterfly sell chart pattern on 5 min chart

The Triangle breakout

occurred with the beginning of the new hourly candle after the previous hourly candle closed exactly at the downward sloping upper resistance trend line of the triangle (Breakout Timing - red thick circle).The Euro found resistance at the daily R1, which coincided with the 161 % butterfly sell pattern on the 5 min chart below. The Euro retraced down close to the typical 161 % Butterfly sell "book" target of this reversal pattern, which coincided with the daily Pivot Point.

The Fibonacci Analysis allowed to figure out support and resistance zones on the EUR/USD. The green ellipses mark Consolidation and Continuation patterns. If price retraces back into the price zone of the prior consolidation pattern then market price often temporarily finds Resistance/ Support at these chart price levels.

|

| 1 hour Triangle Breakout |

|

| 5 min Butterfly sell pattern |

Next Example from June 2012: Triangle Consolidation

|

| 1 hour Triangle Breakout |

On the hourly chart we see that the Euro formed a nice 3 wave triangle consolidation pattern (red triangle) after the explosive up move out of the ending diagonal triangle (blue lines). After the consolidation terminated the Euro slowly moved up from the daily pivot point (no confirmed close below it) supported by the 20 SMA (purple line) and later by the 10 SMA (red line). Market respected (closed at) the weekly pivot at 12 a.m.GMT before the Euro broke through it at the beginning of the 2 p.m. hourly candle. Market moved up to the resistance zone at about 1.25 due to the 61.80 % fib retracement (swing down from 28th to June 1st), the previous low of May 25th (pink line), the 61.80 % fib extension (A-B at C), the 200 SMA and the daily R1. Market could not break this resistance zone so far.

Triangle Pattern in the EURUSD

|

| 1 hour Triangle pattern |

The triangle breakout occurred in today's European Session and it took out the prior low (minimum target of the triangle).

The weekly S3, the daily S2 and the 61.80 % fib extension at 1.2641 could provide some support.

|

| 5 min Chart Analysis |

On the 5 min chart we see that the 100 % fib extension from wave A-B at C at about 1.2756 acted as resistance yesterday. Furthermore, the sharp drop in price yesterday (D-1.2688) found support at the prior consolidation.

The breakout of the triangle occurred shortly after market touched (respected) the blue support line at 10 a.m. GMT (hourly candle). After the touch of the hourly candle the triangle support line got weaker and the break occurred in the beginning of the next hourly candle (11 a.m. GMT).

After market respected a level with the touch of a candle (particularly when the candle closed at this support/ resistance level) the next candle has the chance to break through this level either for a true breakout or for stop fishing the stops placed below the support/resistance (Timing).

The breakout candle on the 5 min chart at 12:25 a.m. GMT fished the stops placed below the recent low and daily S1. However, there was no close of the succeeding candles below the range of the breakout candle (no confirmation, so mainly stop fishing).

No comments:

Post a Comment