Forex Stop Running

Stop and limit order clearing through false breakouts

Today, in the Asian session the Euro triggered/ cleared the stop and limit orders above the high of last week and then started to retrace back at the daily 61.80 % fib retracement and the weekly 10 SMA.

The solely clearing of stop and limit orders at striking price points like market lows and highs is a typical manipulative market behavior and price target of the Forex Manipulators particularly at the first test of these levels with all the stop and limit orders there - false breakouts/ non confirmation.

|

| Daily 61.80 % Fibonacci Retracement |

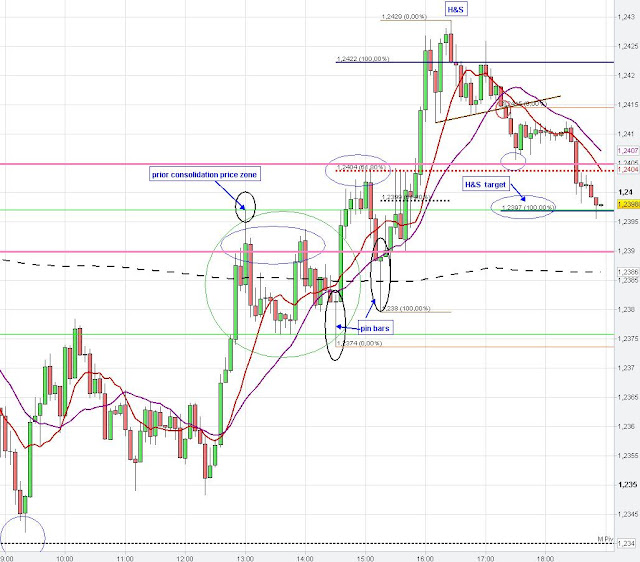

On the 5 min chart (below) we had two pin bars which closed in the price range of the preceding 5 min candle (price rejection/ non-confirmation). Both pin bars led to a reversal, whereby the first pin bar cleared the stops below the recent low which often increases the chance of a price reversal - stop clearing accomplished.

We also had a kind of Head and Shoulders pattern on the 5 min chart. The market reached the Head and Shoulders target (neckline is the brown line).

|

| 5 min pin bar, Head and Shoulder |

No comments:

Post a Comment