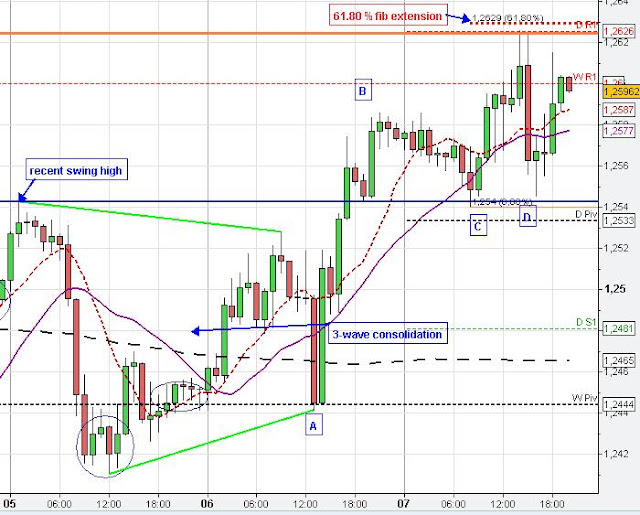

Trading the Fib extension levels

Important Fib Extensions: 61.80 % 100 % 161 %

|

| Daily Candlestick pattern Doji |

Yesterday, the Euro found resistance at January's low 2012 (orange line) and the 61.80 % fib retracement of the recent swing (EUR/USD Market Recap 07.06.12).

Yesterday's daily candle could not close above the 20 SMA and closed in the price range of the prior daily candle (false breakout). Furthermore, market formed a Doji bar or evening star chart pattern, which led to a sharp drop in price in today's Asian and European session.

|

| 1 hour Weekly Pivot point S/R |

Fibonacci Levels and Fibonacci Trading

On the hourly chart we see that the sharp price drop started at 1 a.m. GMT ,right after yesterday's daily doji bar closed. The Euro got initially pushed down by the 10 SMA and 20 SMA. The price drop at 1 a.m. triggered the bear flag (blue circle) and the Euro moved to the 100 % fib extension (A-B at C ) and formed the second bear flag (D) at the green trend line and the 100 % fib extension (also 61.80 % fib retracement).In the following, the Euro broke put of the bear flag and resumed it's down trend to the weekly pivot point. (EUR/USD respected the resistance in form of a bear, which means that market could not sufficiently bounce back from support-bearish signal). Recently, market respected (touched) the hourly 10 SMA (green circle) at 3 p.m. and broke through it with the next hourly candle. The 4-hour candle closing at 4 p.m. also looks like a doji (support at the weekly pivot).

|

| 5 min ending diagonal, bear flag |

On the 5 min chart we see the different bear flags (circled). After EUR/USD broke out of the first bear flag (blue circle) the Euro went to the 161,80 % fib extension (1-2 at 3) where market formed the second bear flag (red circle).The Euro broke out of the bear flag and went to the 100 % fib extension (5-6 at 7).

The EUR/USD found support at the weekly pivot (slightly penetrated but no confirmation, stop fishing below the low of June 6th-blue line) where it formed a kind of ending diagonal ((8-impulsive,9-correction, abcde-ending diagonal). The correction high (9-green line) is the initial target after the ending diagonal terminated, which market reached quickly (directional move). Recently, the Euro found resistance at the daily S2 (1.2492-not shown), the prior consolidation (red circle) and particularly the 61.80 % fib retracement (5-e-not shown) at 1.2493.