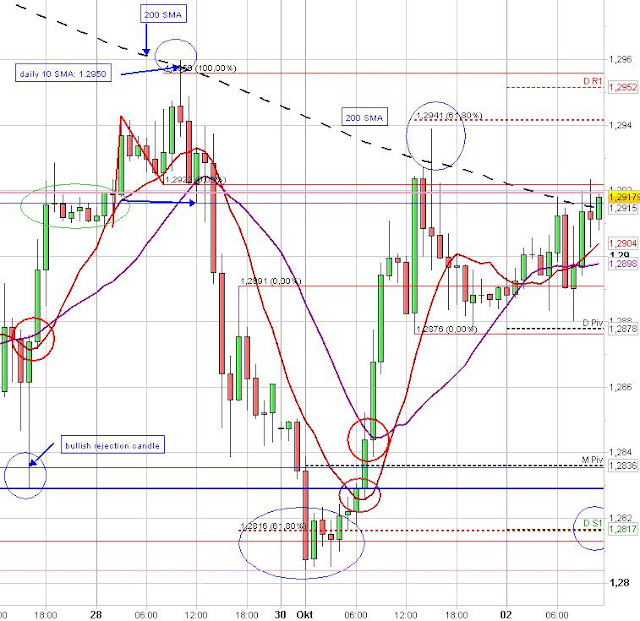

EURUSD Technical Chart Analysis

The 200 Simple Moving Average

The Euro

found resistance at the downward sloping 200 SMA (Simple Moving Average) and support at the daily S1 after market took out the stops and triggered the breakout limit orders below the recent low on the left side of the chart (blue line). After the Stop Run - Market Manipulation - got accomplished there was "nothing" to hold back the Euro from rising upwards. The resistance of the recent low (blue line) and the 20 SMA (purple line) got respected and broken with the beginning of the new hourly candle (Breakout Timing). For example market closed at the 20 SMA resistance with a strong candle and the EUR/USD broke through this resistance level with the beginning of the new hourly candle at 8 a.m. on the 1st October.

In general, the 200 SMA is often acting as support/ resistance and the 200 SMA shows the larger trend direction if the SMA, particularly when this Simple Moving Average is strongly sloping. Otherwise, the 200 SMA indicates a sideways range bounded market when the 200 SMA is more flat than sloping.

|

| 1 hour 200 SMA |