Trading a Sideways Market

Trading in a Range

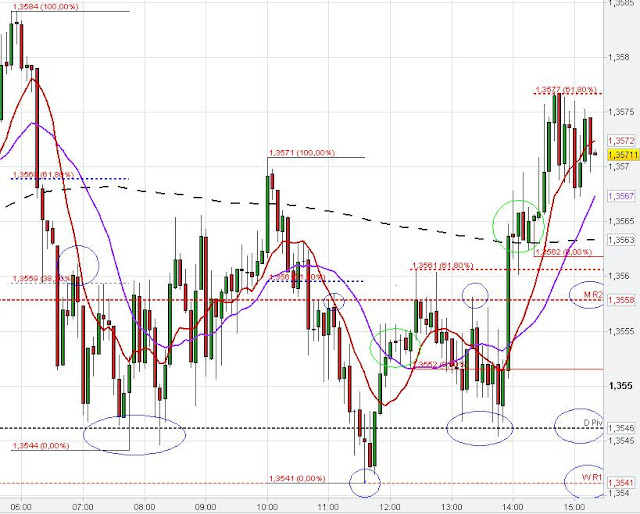

Euro US Dollar market is in a sideways trading range.

Market is waiting for the Nonfarm Payroll Release on Friday, 01.02.2013.

The Euro US Dollar stayed in a sideways range and sideways market on the hourly time frame till now.

The daily Pivot Point and the weekly R1 Pivot held the market today. Fibonacci analysis and Pivot Points provided some possible trading setups in the sideways market to trade the market range in the EURUSD (see chart below).

|

| 5 min Fibonacci Setups and Pivot Point anaylsis |

Another Example for a sideways trading range bound market

The Euro Dollar traded in the hourly consolidation range around the low of November 8th (see EURUSD Chart below).

The European session started with a Stop Run at 6 a.m. GMT. This false breakout on the 5 min Euro chart led to a price reversal of the EUR/USD. Market moved down to the 1.27 level in an impulsive move. However, market price action was capped in the range of this impulsive move during today's trading session.

At 1.10 p.m., the Euro Dollar reversed at the 1.2735 confluence resistance level because of the Fibonacci cluster due to the two 100 % fib extensions from the previous swings up, the daily pivot point and also the penetration of the recent high at 1.2730 on the 5 min chart (Stop Runs above recent high and the daily Pivot). The confluence resistance would have provided a good Trading Setup for a short entry in the market.

We had many continuation patterns (green circles-Pennants, Flags, Ledges), which could have guided today's trading setup decisions. Furthermore, the red circles show where the Breakout Timing strategy could have been applied and the orange arrows show where the Support/ Resistance through the consolidation price zones led to a market reaction. The Fibonacci trading levels also helped to find trading setups in regards of market turning points.

|

| 5 min Trading Setups Euro Dollar |