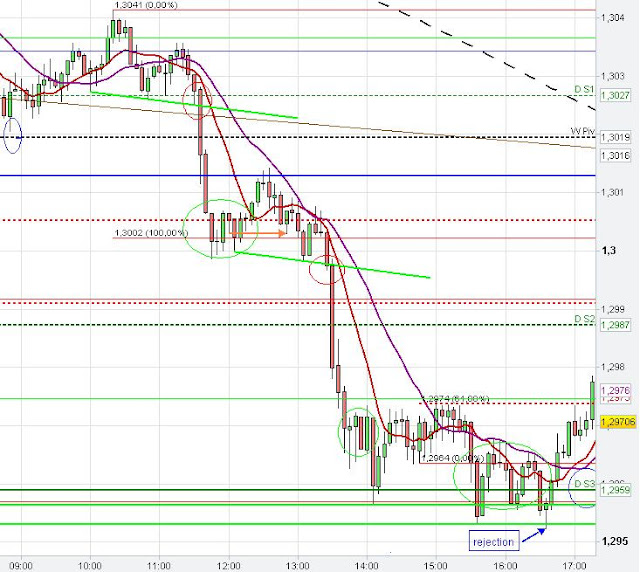

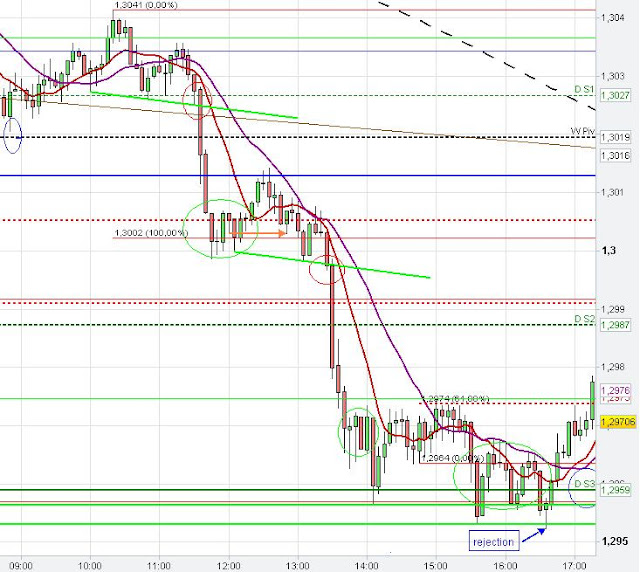

1.30 price zone in EURUSD

Trading Important Chart levels

The Euro

found resistance at the Head and Shoulders neckline yesterday and formed a Three Drives pattern (see 1 hour chart). From this top, the EUR/USD moved down whereby the downside momentum increased today.

The hourly 200 SMA, the daily S1 and the weekly Pivot point provided temporary support for the Euro before the market moved lower to the psychological important 1.30 level.

Many stops can be anticipated below this major psychological level so that at least a temporary breach of this support level could happen to clear some stops. The 61.80 % fib extension at 1.3005 on the 4 hour EUR/USD chart got respected by the 4 hour candle starting at 8 a.m. GMT before the new 4 hour candle breached this important psychological 1.30 level (Timing setup).

The strong 5 min momentum candle at 1.30 p.m. shows the momentum created by the stop triggering and the follow through. The EUR/USD went lower to the next major support level at around 1.2957 created by the 100 % fib extension and the 200 SMA on the 4 hour chart and the daily S3, which supported the Euro US Dollar so far.

On the daily Euro chart we have a potential bearish "222" Gartley pattern.

|

| 4 hour Fibonacci extensions |

|

| Daily Gartley pattern |

|

| 1 hour Head and Shoulders pattern |

|

5 min Neckline break, Momentum

|