Chart Pattern targets

Neckline of the Head and Shoulders

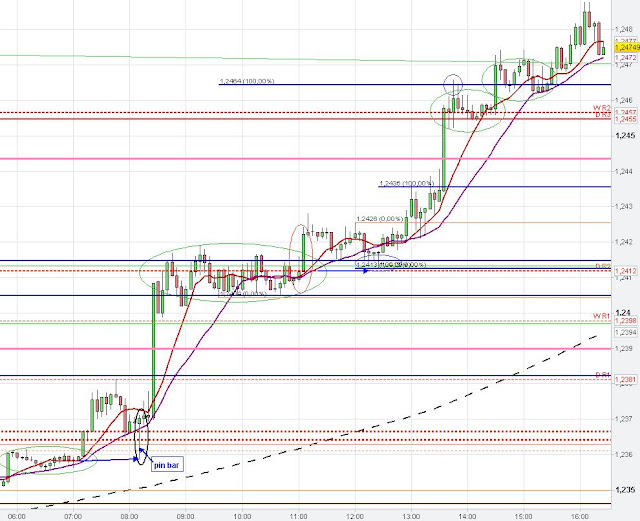

Euro US Dollar

triggered the Head and Shoulders pattern with the break of the neckline and the Euro moved lower to the Head and Shoulders target, which is marked on the chart with the 100 % Head and Shoulders target. From there, the market retraced back up to the Head and Shoulders neckline and formed a kind of Wedge pattern / Three Drives pattern before the EURUSD reversed and moved down again (right side of the chart).Overall, the two hammer candle stick pattern (right side of the hourly chart) and the 61.80 % as well as the 100 % Fibonacci extension levels on the 5 min chart helped us in predicting support and resistance zones.

The first hammer candle occurred at the consolidation price zone of the prior flat "overnight" consolidation pattern of the 21th of October, which acted now as support. The price up moves after the first and the second hammer candlestick created the kind of Wedge/ Three-Drives pattern and market reversed to the downside after the Euro touched the brown neckline of the Head and Shoulders at around 1.3080.

As often, market penetrated an important Chart level like the neckline and the high of the recent overnight consolidation zone of the 19th of October to clear the stop orders and trigger the limit breakout orders before reversing strongly (False Breakouts - Market Manipulation).

|

| 1 hour Head and Shoulders pattern, Fibonacci target |

The Wedge / Three-Drives Pattern is better visible on the 5 min chart. Furthermore, we had two Head and Shoulders pattern on the 5 min chart, see the red lines marking the Head and Shoulders pattern. Both patterns worked out relatively well.

The useful Fibonacci extension levels (61.80 and 100 %) are also visible on the 5 min chart below.

|

| 5 min Head and Shoulders pattern and Wedge |

See also Chart Pattern Manipulation to understand that famous chart patterns are tricky.

The Technical Chart Analysis of the trading days before below

The EURO

found support at the Head and Shoulder price target (100 % fib extension of the Head and Shoulders height moved to the neckline break), daily S2 and 100 % Fibonacci swing projection. Pivot Points and Fibonacci extension levels only held the market temporarily. The red ellipses underlined the Breakout Timing Strategy (Break of support of the new hourly candle after previous hourly candle closed bearish at the support level).

|

| 1 hour Head and Shoulders pattern target |

|

| 5 min Three Drives pattern |

The Developing of the Head and Shoulders pattern

Head and Shoulders neckline and Fibonacci Analysis

on hourly chart but neckline and daily S1 held the market so far. The Euro found resistance at the weekly S2.

In today's session the Euro often found resistance and support at 61.80 % and 100 % Fibonacci extension levels and market often cleared the stops (stop fishing - false breakout) below recent lows (see red arrows on 5 min chart).

The Fibonacci Extension and Retracement levels as well as the Pivot Points revealed important Support and Resistance zones (5 min chart analysis)

|

| 1 hour Head and Shoulders neckline |

|

| 1 min Head and Shoulders pattern |

|

| 5 min Fibonacci levels |