Support and Resistance Trading

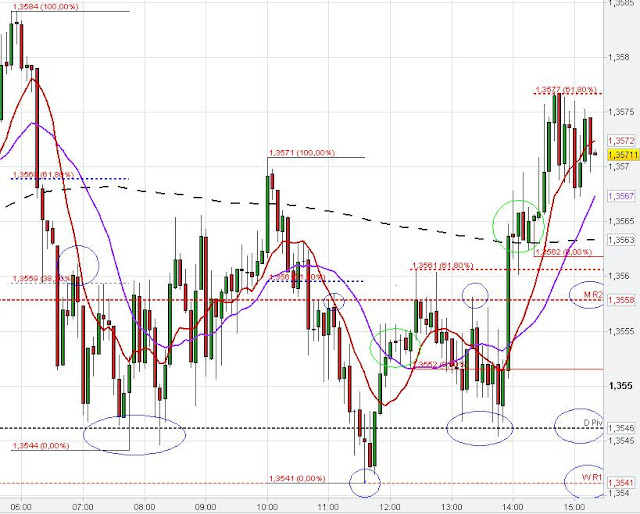

The Euro USD very often respected the different daily and weekly Pivot Points as support and resistance on the 5 min Intraday Chart. The daily Pivot Point held the sharp intraday downtrend after the Nonfarm payroll release today and the Euro USD reversed sharply up for new highs in the trading session. 61.80 % and 100 % Fibonacci extension levels also helped to determine intraday support and resistance zones.

The Euro moved only shortly into the 1.37 vicinity before retracing back. The daily R1, daily R2 and the weekly R2 beautifully show the changing role from resistance to support. The daily R1 was resistance at 7 a.m. GMT and after resistance got broken the resistance became support between 10 a.m. and 2 p.m.. Similarly, the daily R2 and the weekly R2 acted as resistance before the role changed depending on the vicinity of price action. The chart formation at around 10 a.m. GMT might be seen as a small Head and Shoulder pattern at the daily R2 resistance.

|

| 5 min Changing role resistance to support |

The below EUR/USD Chart shows how the monthly R2 Pivot point changed its role from resistance (at 11 a.m.) to support after market broke this resistance level and confirmed the breakout at about 3 p.m..

|

| 5 min Resistance becomes support |