Continuation Trading Chart Patterns

Trading Flag patterns, Pennants and Ledges

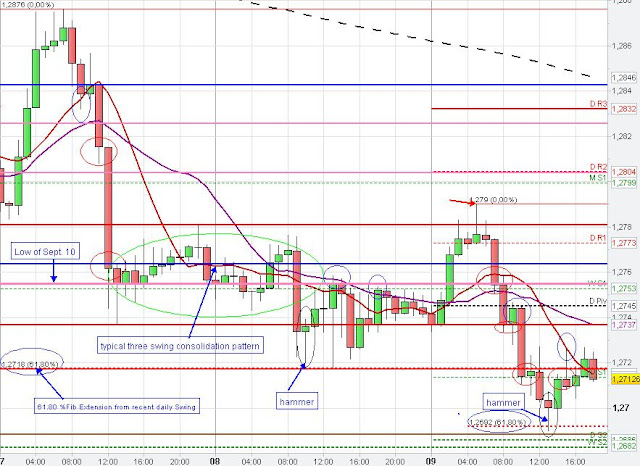

EUR/USD

|

| 4 hour Chart Pattern/ Analysis |

On the 5 min chart we see many Continuation chart patterns (Flag patterns, Pennants, Ledges - see green circles), which got triggered and market resumed its downward trend. Very often the EUR/USD made attempts to renew its downtrend with the beginning of the new trading hour for a true or false break of support, frequently after closing at support level e.g. 8 a.m., 9 a.m. 11 a.m. 1 p.m. and vise versa for the uptrend at 3 p.m. and 5 p.m. (see red circles on hourly chart - Breakout Timing).

The Consolidation pattern between 11 a.m. and 12:20 p.m. GMT can be seen as a bear flag of the recent impulsive downward move from 10 a.m. to 11 a.m. (5 min chart).

The daily Pivot point changed its role from support to resistance after the break of this level 8:45 a.m. (see 5 min chart).

The Euro found some support at the Fibonacci Cluster at around 1.2692, the 61.80 % Fibonacci Extension of the recent 4-hour swing down and the 100 % Fibonacci Extension level on the 5 min chart. From there, market leveled off.

|

| 1 hour Continuation Chart Patterns Analysis |

|

| 5 min Continuation Chart Patterns (Flag patterns, Pennants, Ledges) |