Resistance/ Support levels

Changing Role of Resistance and Suppor

|

| 1 hour Trading Signals | Changing role Resistance to support |

Resistance becomes support

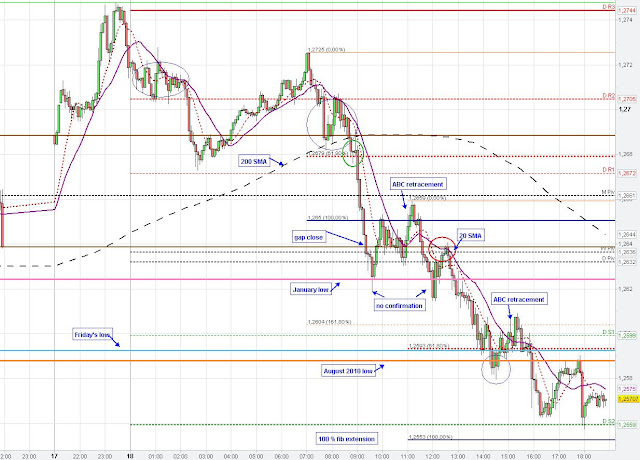

On the 1 hour chart we see the changing role of the key level at 1.2588 (August 2010 low-orange line). Yesterday in the US session the Euro closed below this level at 3 p.m. GMT and in the following the Euro found resistance at the orange line. However, the Euro got supported by the hourly 200 SMA (black line) and the EUR/USD move above the orange line again in today's overnight session. Now, the orange line acted at support (prior resistance becomes support) and the Euro did not close below this level on an hourly basis.

EUR/USD penetrated the orange line between 9 a.m. -10 a.m. but market bounced back again from the 200 SMA (yesterday's consolidation also provided some support at this price level) and closed finally above the key support on the hourly chart. From there, the Euro moved up to the next key level at 1.2624 (pink line-January low).

The Euro could not overcome this level for a while, however, EUR/USD also did not significantly bounced back from this resistance. The resistance got further strengthened due to the daily pivot at 1.2629. Market formed a bull flag on the hourly chart and the Euro broke through resistance (pink line) with the beginning of the 2 p.m. hourly candle after market repeatedly slightly penetrated this level during the three hour consolidation (bull flag-eroded resistance over time). Moreover, the bull flag terminated exactly at the 100 % time projection of the prior upswing (A-B at B, 5 min chart below).

After the break of the strong resistance (pink line) market gained strong bullish momentum. The 2 p.m. hourly candle closed above the weekly pivot, the 3 p.m. hourly candle above the monthly pivot and the 4-hour candle closing at 4 p.m. closed (respected) at the 61.80 % fib retracement and market breached the 61.80 % fib retracement initially after the 4 hour candle closed (red circle on hourly chart).

|

| 5 min Day Trading Strategies |

On the 5 min chart we see that the Euro initially moved to the 61.80 % fib extension (A-B at C) after the breach of the pink line. The Euro found some resistance there and bounced back to find support at the rising 10 SMA (red line) on the 5 min chart and the Euro got repeatedly pushed up after touching the rising 10 SMA (strong bullish momentum).

The 5 min chart also highlights the changing role (support/resistance) of the orange line. EUR/USD repeatedly reacted at this level (1.2588).