Market Gaps Analyzed

Closing the Market Gap

|

1 hour Gap Trading |

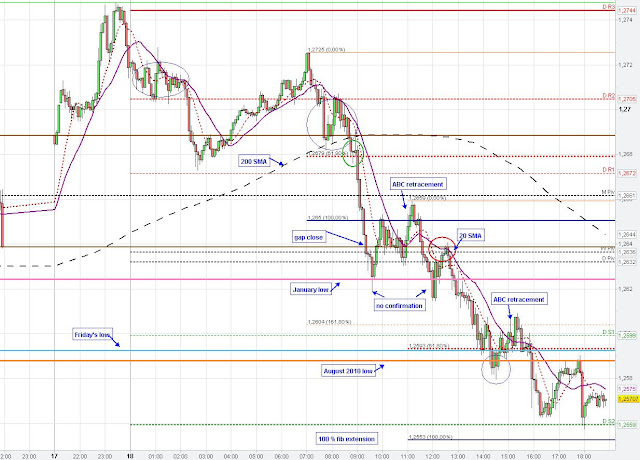

The Euro gaped up to 1.2748 and from there EUR/USD started to move down and completely retraced/ closed the market gap and the market even fell much further.

The 2 a.m hourly candle found support at the 10 SMA (red line) and the Euro started to retrace up to 1.2725 supported by the rising hourly 10 SMA. After the end of the upward retracement the Euro resumed its downtrend and closed today's gap.

The 8 a.m. hourly candle respected (touched) the hourly 20 SMA (purple line) after the Euro consolidated between the 20 SMA and 200 SMA on the 5 min chart, and the Euro initially broke through the 20 SMA with the beginning of the new hourly candle at 9 a.m. (London open- green circle on 5 min chart).

The Euro found some temporary support at the pink line (low of January) and formed an abc-retracement up to the monthly pivot point. From there, the Euro bounced back and penetrated the pink line again but market could not confirm the breakout on the 5 min chart.

|

5 min Daily Gap Trading Setups |