Important levels and Patterns for Trading

Key Support/ Resistance

On the 4 hour and 1 hour chart we see that the Euro very often closed at (traded/ consolidated around) the low of January 2012 at 1.2624 key level, pink line), which coincides with the daily high of the 7th of June and the gap opening on Monday. Particularly on the 4 hour chart we see that every candle today closed at this important chart level.

|

| 4 hour Changing role from resistance to support |

|

| 1 hour Daily Pivot Point S/R |

Head and Shoulders neckline

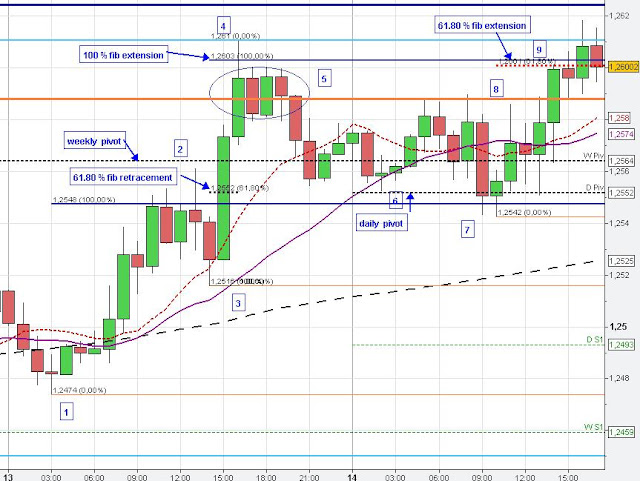

On the hourly chart we see that the Euro respected the 61.80 % fib extension at 5 a.m. (recent high) and price moved lower from there. On the 1 hour and 5 min chart (below) we see a nice Head and Shoulders pattern. At 11:15 a.m. the Euro breached the neckline (brown line) (A) but market could not confirm this breakout (first test).

The second break of the neckline occurred at 12:45 p.m. and market moved to the 100 % fib extension (B). EUR/USD breached the daily pivot point - key level-, however, the pivot point, the 4-hour 10 SMA and trend line (4-hour chart) supported the market. The Euro managed to close above the neckline on the hourly chart at 2 p.m. after a choppy price action between the neckline and the weekly pivot.

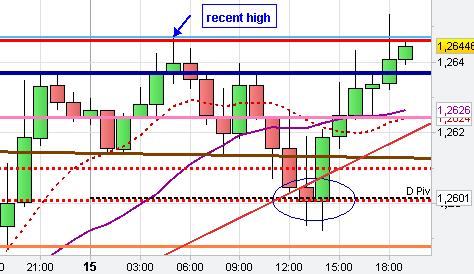

On the 5 min chart (below) we again see the importance of the pink line and its changing role from resistance to support vice versa -key Support/ resistance chart level. The Euro formed a bull flag on the 5 min chart and in the following closed above the pink line after market already regained the neckline with the hourly close at 2 p.m.. The Euro bounced back from the pink line at 5:25 p.m. (now support) and cleared the stops above the recent high (C). However, market could not close above the recent high on the 5 min chart at the first breakout (only stop fishing) and the Euro fell back again.

|

| 5 min Important Tradind Chart levels and Patterns |