Fibonacci extensions and Fibonacci

Fibonacci retracement

EURO US Dollar

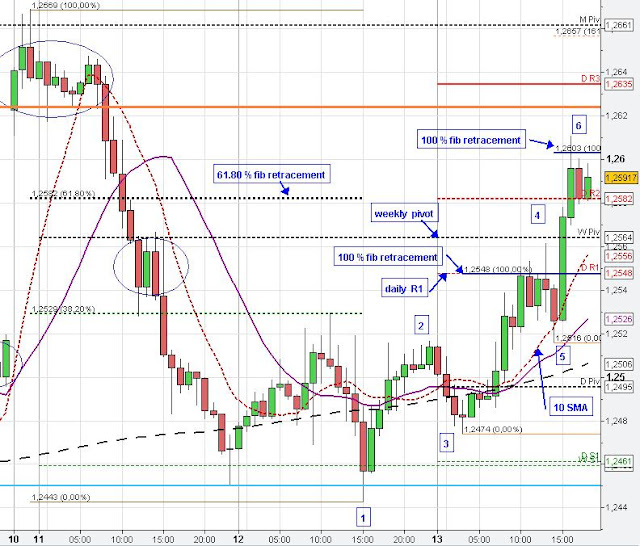

found resistance at the 100 % Fibonacci extension (1.2603) (4) and bounced back to today's daily pivot point (1.2552) and the 61.80 % Fibonacci retracement (6). From there, the Euro US Dollar formed a larger consolidation around the weekly pivot at 1.2564 on the hourly chart. During this consolidation the Euro Dollar did not confirm a break below the weekly pivot point on the hourly chart after yesterday's confirmed upward penetration of this level (4 p.m-yesterday) .

The recent consolidation pattern at yesterday's high (5) and the low of August 2010 (orange line/ weekly chart-last chart) seem to have capped the market to the upside recently (8). Since the break below orange line on Monday the Euro struggled to confirm an upward break through this level again on the hourly chart. However, the 4 p.m. hourly candle confirmed the upward break of the orange line on the hourly chart after market paused at the 61.80 % Fibonacci extension (3-4 at 7). But in general, the price action on the daily chart might be more important in analysing the price behaviour around weekly support/ resistance.

|

| 1 hour Fibonacci trading |

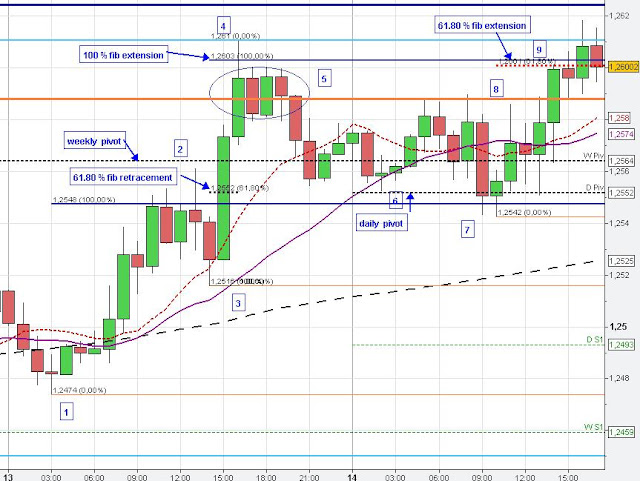

On the 5 min chart (below) we see that the Euro retested the daily pivot point at about 10 a.m. GMT but market could hold at support. The initial breakout candle at 9:55 a.m.did not get confirmed on the 5 min chart.

The Euro consolidated around the daily pivot point (B) and moved up again (no confirmed break of the daily pivot point). The daily pivot and the recent consolidation (B) at this price level held the market again at 1:10 p.m (C) and the Euro moved up again. At 2:40 p.m. the Euro bounced strongly back from the weekly pivot point and the 61.80 % Fibonacci retracement (D) after the Euro formed a higher low (1:10 p.m.) and higher high (1:55 p.m.) on the 5 min chart.

The Euro consolidated at the 61.80 %Fibonacci extension before market resumed its uptrend and breached the recent high (blue line-stop clearing target) but the Euro found resistance at the 61.80 % Fibonacci extension on the 5 min chart (G) (first breakout often false one) and market price closed below the blue line (recent high) on the hourly (4 p.m.). The Euro found some temporarily support at the price level of the prior consolidation (H) and market formed a bear flag before market went lower (not shown).

| ||

5 min 61.80 % Fibonacci level

|